Introduction:

One can, surprisingly enough, use excel for conducting a forensic audit. Before jumping to that discussion, lets start with an introduction of auditing procedures. There are two types of procedures that attempt to minimize fraud in financial transactions – one called Statutory Procedure and one utilizing Forensic Techniques.

The first technique is primarily concerned with following procedure and rules, making sure that documentary evidences are present, regulations are followed and so on. Forensic technique relies on the micro approach, questioning the authenticity of the documents and transactions and focusing on gathering evidence of any possible fraud.

As the later techniques relies on collection of data and its analysis to find a clue, we can use excel to support performance of such technique.

We will look at five examples to see how Excel can help up speed up these tasks:

Identifying Duplicate Transactions using Highlight Values:

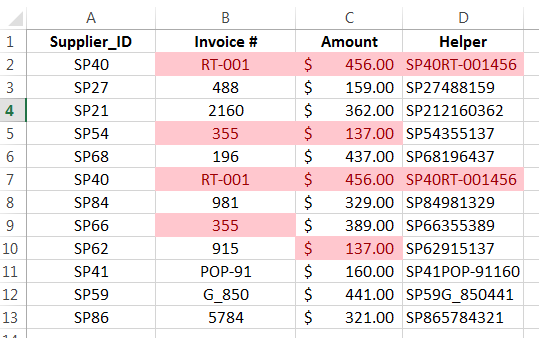

Consider the following instance where we have a supplier name or code, supplier invoice number and the amount. There is a chance that one might have a duplicate amount number or duplicate invoice number for different suppliers – but what if a pair of records have exactly the same data for all the three parameters? This is a definite case of duplicate invoices existing:

In the above example we have produced the column D by concatenating the data in the first three columns and then applying the conditional formatting for duplicate values. (The exact formula is =A2&B2&C2 in cell D2 and then dragged down, the conditional formatting on cell D2:D13 can be applied by accessing Highlight Values Menu from Home Tab.)

As you can see from this screenshot, various duplicates are highlighted in the second and the third column as well as the fourth column. We can ignore the duplicates in the second and third column as invoice number and amount could be the same for different suppliers – but the duplicate value in the fourth column means that all the three parameters are the same. This points to a definite duplicate entry that should be checked.

Analyzing Round Numbered Transactions:

If a forensic accountant is getting too many round numbers, it is time to check the accuracy of the document or ask for further support. Too many round numbers may indicate something fraudulent is occurring.

Excel has a built in function called MOD () to analyze if a number is a round number or not. The dynamics of the formula are simple – we add the following formula in the example sheet to find if the number has to be checked for something potentially fraudulent:

=IF(MOD(A2,100)=0,”Check”,”-“)

The formula will return a non-zero number and the result can be presented as-is or nested into an IF() statement to give the desired result:

Above Average Payments to Vendors or Checking the Ratio between a Maximum and Minimum:

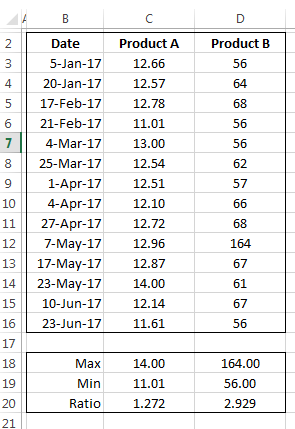

For a product, prices usually fall within historical ranges. If anything goes beyond the average, the entry can be question and should be verified. Consider data in the following table that has price listed for two different products. These products are bought over a period of six months and their prices vary between a minimum of 11.01 and a maximum of 14, whereas the ratio of the max/min is 1.272. Compared to this, if we look at the second product, we find this ratio to be 2.9 times or almost 3 times. This points to a discrepancy.

Gap Detection:

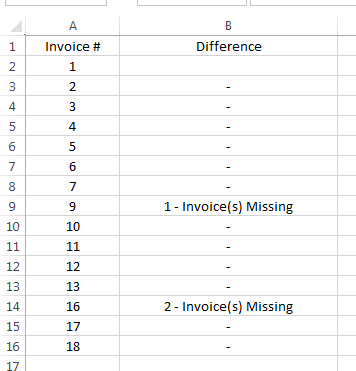

This is a test that uses a simple fact that any missing invoice (number) in the sales database can indicate a potential problem. This test can be done for such a document and help drive for further inquiry of the preparer.

In excel we can do this test by first sorting the invoice number and then taking the difference of consecutive invoices. The following screenshot how the excel sheet is setup for this case:

In the above example, we have setup a formula that calculate the difference between the two consecutive invoice numbers, if it is one, then its okay and we move forward. If not, it means that an invoice number was skipped – we can then write a conditional formula with IF() that can give us a custom message like this:

=IF(A3-A2<>1,A3-A2-1&” – Invoice(s) Missing”,”-“)

The above formula checks if the difference is one, if not, we have a custom message that “n-invoices are missing”. Otherwise, we will have a blank cell.

Checking Ratio of the Highest to the Second Highest Number:

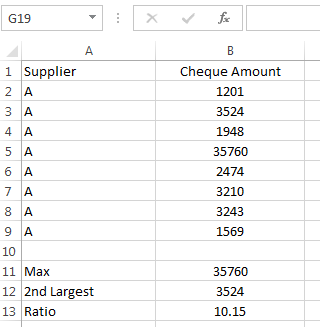

This is again a procedure that relies on the use of finding maximum, but not just maximum but also the second largest number in the data.

Consider the following data for a part purchased from a supplier:

We can use build in function MAX() and LARGE() to find the maximum and the second largest value in the data. As we take the ratio of the data, we find it to be 10 times the maximum number. This means that maximum for the data is much larger than the usual average value.

Conclusion:

We cannot eliminate mistakes or “fudging” in the financial data however we can positively try to minimize it. We have seen five techniques that can be applied using a standard tool like MS Excel for tracing such issues. Please download the attached file to see it working practically.